Download the app today and use the code Provision to get a your first month free

Steward your money with wisdom

Provision is the financial management app for UK Christians.

Understand and manage your spending, giving and saving without

manually entering your transactions.

Welcome to Provision

Helping you confidently steward all that God has provided with a personal finance app made by Christians, for Christians. We give you the tools and insights you need to understand exactly how you are spending, saving and giving. Unlike other financial tools, we focus on stewardship, not wealth accumulation, supporting you to honour God with your finances.

Know your finances

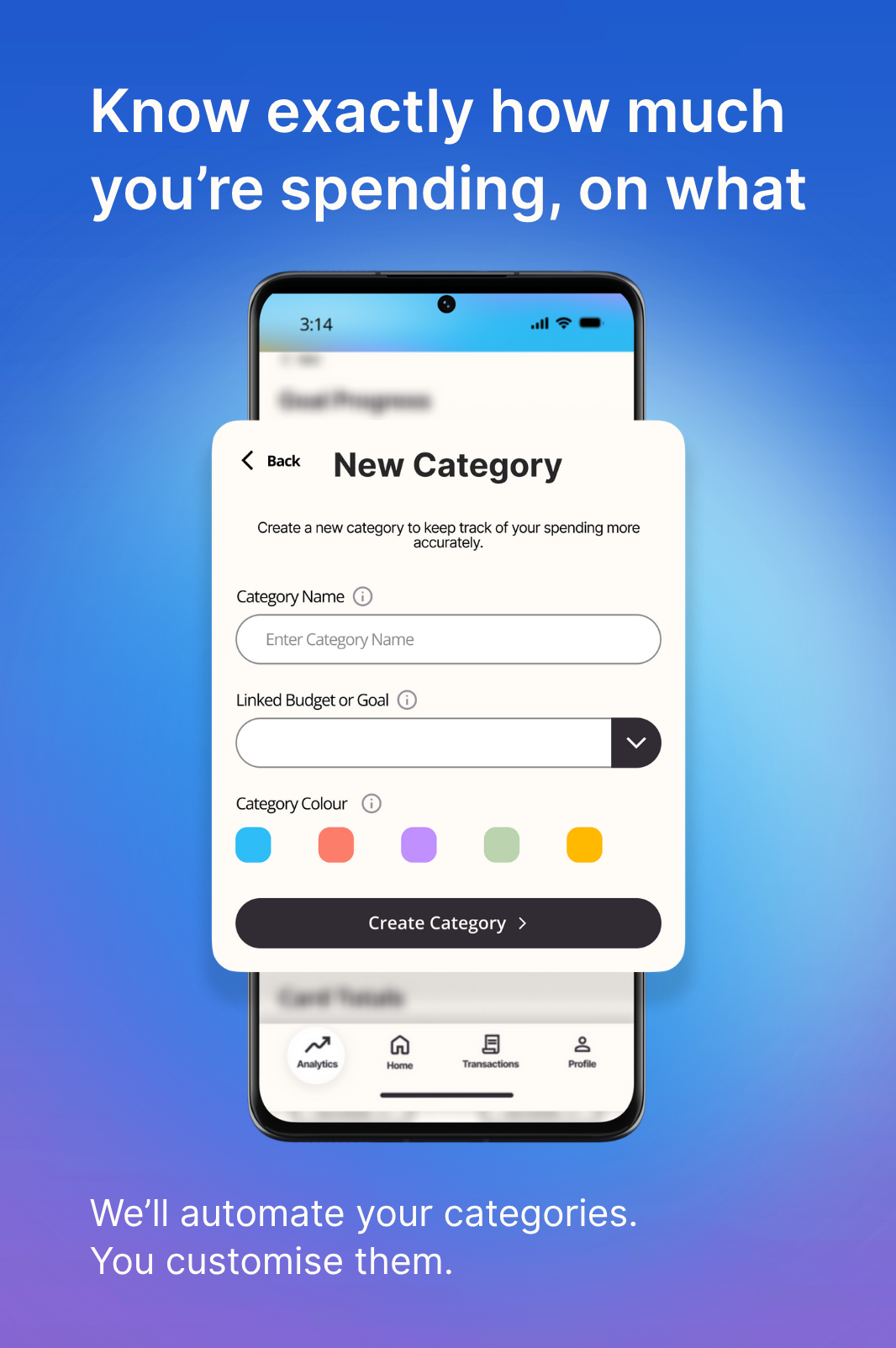

Know exactly how much you're spending, on what. We'll automate categories for your transactions. You customise them. Then create and manage your budgets and savings goals. You can break down how you're giving, set targets bespoke to you and see how your spending changes over time. Use these insights to pray about your financial habits and take meaningful action.

Safe and secure

Connect multiple UK debit, credit and savings accounts to see all your finances in one place. We're powered by Open Banking Standards. You don't need to share any sensitive banking details and we keep your data encrypted. We ask you to refresh your consent every 90 days, meaning you're always in control. And biometric login keeps your data secure.

Frequently Asked Questions

As we use Open Banking to give you visibility of your transactions, you will never need to share your bank details with us to use the app. All your data is encrypted end to end. Our employees are unable to see any of your transactions or account balances.

We also ensure that the app undergoes regular penetration tests to ensure your data continues to be safe and secure. Provision is authorised and regulated by the FCA (Financial Conduct Authority) Firm reference number: 1037716 as an agent of Open banking provider MoneyHub Financial Technology Limited, FCA reference number; 809360.

This means we have the legal right to access and display banking information of any users who wish to use the app.

All bank accounts and credit cards you add to the Provision app connect through the Open

Banking Standard.

Connecting your accounts will give Provision read-only access to display your transaction

data so that you can use the app. Money cannot be transferred. You don’t need to share any

sensitive banking details with us to login and we keep your data encrypted.

The consent you give us to see your data will expire every 90 days or you can choose to disconnect at any time.

Enabling biometric login to the Provision app keeps your data even more secure.

For more information, see the Money Saving Expert page on Open Banking. This link will take

you to their website: https://www.moneysavingexpert.com/banking/open-banking/

No, you can't make financial transactions like bank transfers or credit card payments with the app. Provision provides a read-only view of transactions from accounts you add, which you can then categorise and analyse. We can't make any changes to your accounts or the money in them.

As many as you'd like. We have coverage across most major UK banks.

You can add current, savings and credit card accounts to Provision so you can see all your accounts from most major UK banks in one place.

We will automatically categorise every transaction. You can change any transaction, create your own categories and link any category to a budget or goal you've created. That's totally up to you!

Connect as many accounts as you'd like and access all app features for just £4.29 per month and cancel anytime. Save by signing up for £45.00 a year, which works out at £3.75 a month.

We're here to help. Please email support@provision.money and we'll get back to you as soon as we can.

No, nothing you do to track your spending in the Provision app will affect the original information from your bank accounts and credit cards. If your bank already provides categorisation information, this will not change if you categorise transactions in the Provision app.

No, Provision is only available for most major UK accounts.

Provision syncs with your accounts every two hours. If you check back soon, all your latest transactions will be showing in the app.

Connect as many accounts as you'd like and access all app features for just £4.99 per month and cancel anytime. Save by signing up for £49.99 a year.

About Us

Founded in 2025, Provision Money is led by Matt and Beks. We're a husband and wife duo who love the Lord and worship in South London.

Matt has worked in tech and digital product for the last 8 years with a range of public, private and charity sector organisations.

We pray our app will be a blessing to you.

“Each of you should use whatever gift you have received to serve others, as faithful stewards of God’s grace in its various forms.”

1 Peter 4:10

Continue with Google

Continue with Google

Continue with Apple

Continue with Apple